Federal Historic Preservation Tax Credit projects have generated billions of dollars in spending in California. Between 2009 and 2024, almost 3 billion dollars were spent on rehabilitation expenses. These projects create jobs, housing, businesses, and increased state and local tax revenue.

Economic and Tax Impacts of the Federal Tax Credit in California 2020 - 2023

From the most recent information compiled by the NPS for the fiscal years 2020, 2021, 2022, and 2023

Fiscal Year/

|

2020 |

2021 |

2022 |

2023 |

|---|---|---|---|---|

| Projects Completed | 3 | 8 | 4 | 6 |

| Total Rehabilitation Costs | $43,300,000 | $138,000,000 | $155,100,000 | $233,000,000 |

| Jobs Created | 645 | 2,058 | 2,314 | 3,475 |

| Post-Rehab Housing Units | 41 | 318 | 36 | 159 |

| State Tax Revenue Generated | $1,700,000 | $5,600,000 | $6,300,000 | $9,400,000 |

| Local Tax Revenue Generated | $1,100,000 | $3,500,000 | $3,900,000 | $5,900,000 |

Annual Reports of all certified tax projects since 2021 are available at OHP's Completed Federal Tax Incentive Projects web page. Contact the Architectural Review unit for information on tax credit projects before 2021.

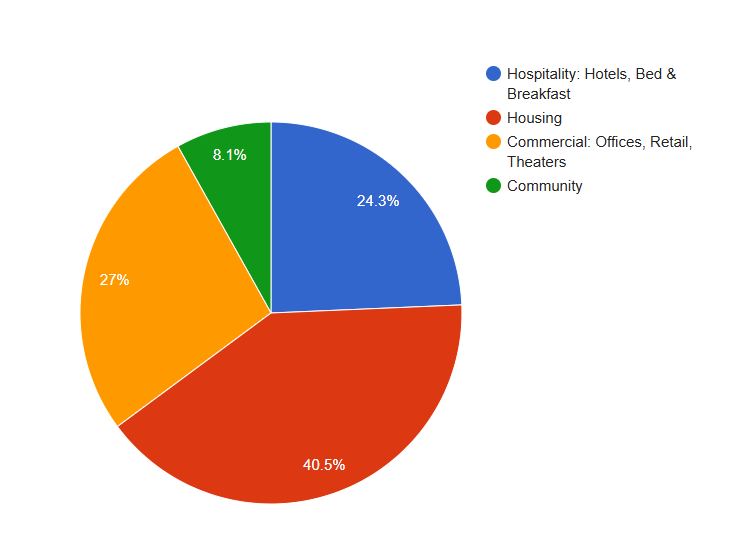

Post-Rehabilitation Building Use

Below is a breakdown of the building use of the 37 California Federal Rehabilitation Tax Incentive Projects completed since 2020